With the potential for tax-free retirement income, Roth IRAs may be appealing investment vehicles.

There are three ways to fund a Roth IRA — you can open an account and contribute directly, you

can convert all or part of a traditional IRA to a Roth IRA, or you can roll over or convert funds from

an eligible employer retirement plan.

- Open account, contribute directly

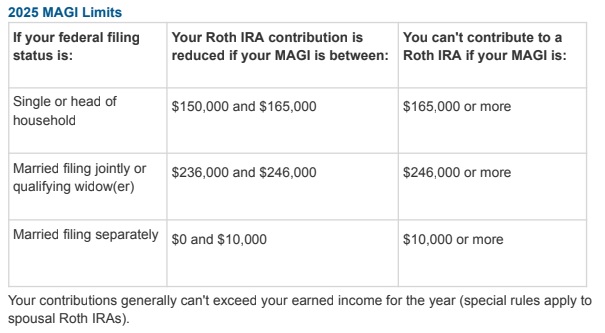

In general, you can contribute up to $7,000 to an IRA (traditional, Roth, or a combination of both) in 2025 (unchanged from 2024). Those age 50 and older may contribute an extra $1,000 in 2025

(unchanged from 2024). However, your ability to make annual contributions to a Roth IRA may be

limited (or eliminated) depending on your modified adjusted gross income, or MAGI, as shown in the table below.

- Convert traditional IRA assets

The second way to fund a Roth IRA is to convert a traditional IRA to a Roth IRA. Regardless of your

filing status or how much you earn, you can convert a traditional IRA to a Roth IRA. (There’s one

exception — you generally can’t convert an inherited IRA to a Roth. Special rules apply to spouse

beneficiaries.)

SEP IRAs and SIMPLE IRAs can also be converted to Roth IRAs (for SIMPLE IRAs, you’ll need to

participate in the plan for two years before you convert). You’ll need to set up a new SEP/SIMPLE

IRA to receive any additional plan contributions after you convert.

If your income exceeds the limits that allow you to make direct contributions, you can still potentially benefit from a Roth IRA by using a conversion workaround (sometimes called a “back door” Roth IRA). You would simply make a nondeductible contribution to a traditional IRA and then convert that traditional IRA to a Roth. There are no limits to the number of Roth conversions you can make.

How do you convert a traditional IRA to a Roth?

Start by notifying your existing traditional IRA trustee or custodian that you want to convert all or part of your traditional IRA to a Roth IRA, and the custodian/trustee will provide you with the necessary paperwork. You can also open a new Roth IRA at a different financial institution and then have the funds in your traditional IRA transferred directly to your new Roth IRA. The trustee/custodian of your new Roth IRA can give you the required paperwork. If you prefer, you can instead contact the trustee/custodian of your traditional IRA, have the funds in your traditional IRA distributed to you, and then roll those funds over to your new Roth IRA within 60 days of the distribution. The income tax consequences are the same regardless of the method you choose.

Calculating the conversion tax

When you convert a traditional IRA to a Roth IRA, you’re taxed as if you received a distribution, but

with one important difference — the 10% early-distribution tax doesn’t apply, even if you’re under

age 591⁄2. However, the IRS may recapture this penalty tax if you make a nonqualified withdrawal

from your Roth IRA within five years of your conversion.

If you’ve made only nondeductible (after-tax) contributions to your traditional IRA, then only the

earnings, and not your own contributions, will be subject to tax at the time you convert the IRA to a

Roth. But if you’ve made both deductible and nondeductible IRA contributions to your traditional IRA, and you don’t plan on converting the entire amount, things can get complicated. Under IRS rules, the amount you convert is deemed to consist of a pro-rata portion of the taxable and nontaxable dollars in the IRA.

For example, assume that your traditional IRA contains $350,000 of taxable (deductible)

contributions, $50,000 of nontaxable (nondeductible) contributions, and $100,000 of taxable

earnings. You can’t convert only the $50,000 nondeductible (nontaxable) contributions to a Roth and have a tax-free conversion. Instead, you’ll need to pro-rate the taxable and nontaxable portions of the account. So in the example above, 90% ($450,000/$500,000) of each distribution from the IRA

(including any conversion) will be taxable, and 10% will be nontaxable.

You can’t escape this result by using separate IRAs. Under IRS rules, you must aggregate all of your

traditional IRAs (including SEPs and SIMPLEs) when you calculate the taxable income resulting

from a distribution from (or conversion of) any of the IRAs.

Some experts suggest that you can avoid the pro-rata rule and make a tax-free conversion if you

take a total distribution from all of your traditional IRAs, transfer the taxable dollars to an employer

plan like a 401(k) (assuming the plan accepts rollovers), and then roll over (convert) the remaining balance (i.e., the nontaxable dollars) to a Roth IRA. The IRS has not yet officially ruled on this

technique, so be sure to get professional guidance before considering this.

- Roll over or convert employer plan funds

You can also roll over or convert funds from an employer plan [such as a 401(k)] to a Roth IRA. You

can roll over amounts held in a Roth employer plan account directly to a Roth IRA, or you can

convert non-Roth funds to a Roth IRA. Like traditional IRA conversions, the amount you convert will be subject to income tax in the year of conversion (except for any after-tax contributions you’ve made). Keep in mind that employer plans typically offer several distribution options. In addition to rolling over both Roth and non-Roth 401(k) plan assets to a Roth IRA, you generally can also (1) leave the savings in your former employer’s plan, if allowed; (2) transfer assets to a new employer’s plan, if allowed; (3) take the distribution in cash. A cash distribution will result in a tax obligation on the taxable portion of the distribution and may be subject to a 10% penalty tax if you are younger than 591⁄2, unless an exception applies.

Is a Roth IRA right for you?

The answer to this question depends on many factors, including your current and projected future income tax rates, the length of time you can leave the funds in the Roth IRA without taking

withdrawals, your state’s tax laws, and how you’ll pay the income taxes due at the time of the

conversion.

Securities offered through IFP Securities, LLC, dba Independent Financial Partners (IFP), member

FINRA/SIPC. Investment advice offered through IFP Advisors, LLC, dba Independent Financial

Partners (IFP), a Registered Investment Adviser. IFP and Hitchcock Maddox Financial Partners are

not affiliated. This is for educational and information purposes only and is not research or a recommendation regarding any security or investment strategy. Neither IFP Advisors LLC, IFP Securities LLC, dba Independent Financial Partners (IFP), nor their affiliates offer tax or legal advice. Any potential tax advantages or benefits will depend on your circumstances. Consult your

tax professional and/or legal expert about your individual tax situation and visit IRS.gov to learn more. Courtesy of Broadridge – Advisor Solutions.