In recent years, investors have had little respite from unsettling headlines.From the Covid pandemic to inflationary shocks, geopolitical tensions, and sharp market swings, it can feel as though we’re moving from one global crisis to the next with barely a moment to breathe.For those newly retired or on the cusp of a major life transition,…

Category: Uncategorized

Charitable Giving

When developing your estate plan, you can do well by doing good. Leaving money to charity rewards you in many ways. It gives you a sense of personal satisfaction, and it can save you money in estate taxes. A few words about transfer taxesThe federal government taxes transfers of wealth you make to others, both…

The 12 principles of investing (A Christmas guide to financial wisdom)

As the festive season unfolds, with markets buzzing, tills ringing, and the sound of Mariah Carey playing in almost every bar in the country, it’s easy to get caught up in the magic of the moment. But when it comes to investing the real value isn’t the short-term, one-off thrill – it’s about the long-term…

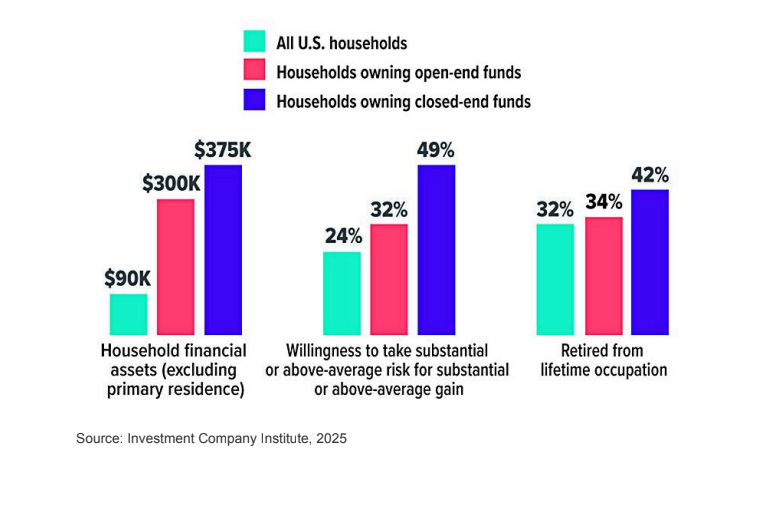

Closed-End Funds Could Help Boost Investment Income

Most mutual funds are open ended, which means that the investment company can issue and redeem fund shares to meet investor demand. By contrast, closed-end funds issue a fixed number of shares in an initial public offering (IPO), and investors who want to purchase shares after the IPO must do so on a secondary market,…

Left Your 401(k) Behind After A Job Change? It Could Cost You A Small Fortune In Retirement

Leaving a 401(k) at a former employer could shrink your nest egg. These steps could help protect your retirement and boost savings. Imagine retiring with $90,000 less in your nest egg—not because of a bad investment, but because you forgot about old 401(k) accounts from past jobs. In today’s job market, where career transitions are…

Getting Started: Establishing a Financial Safety Net

In times of crisis, you don’t want to be shaking pennies out of a piggy bank. Having a financial safety net in place can help ensure that you’re prepared when a financial emergency arises. One way to accomplish this is by setting up a cash reserve, a pool of readily available funds that can help…

A different way to think about financial goals

As far as achievements go, Tara Dower’s speed run of the Appalachian Trail surely takes some beating. The professional ultrarunner completed the 2,200 miles from Maine to Georgia in just 40 days and 18 hours, beating the previous fastest known time by 13 hours. The path usually takes between five and seven months (and only…

Health Insurance in Retirement

At any age, health care is a priority. When you retire, however, you will probably focus more on health care than ever before. Staying healthy is your goal, and this can mean more visits to the doctor for preventive tests and routine checkups. There’s also a chance that your health will decline as you grow…

Versatile 529 Plans Can Help with More than Just College

529 plans were originally created in 1996 as a tax-advantaged way to save for college. Over the pastseveral years, Congress has expanded the ways 529 plan funds can be used, making them a moreflexible and versatile savings vehicle. College, plus other education expensesA 529 savings plan can be instrumental in building a college fund —…

Should I buy or lease assets for my business?

This decision depends on several factors, such as the cost of the asset, your cash and/or credit position, and the asset’s value to you now and in the future. In the short term, leasing an asset allows you to try out a product without making a lengthy commitment. If you find the item does not…